✅ DIR-3 KYC Due Date Extended to 15th October 2025 – File with Expert CA in Delhi

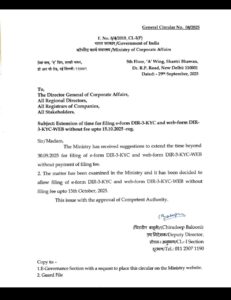

As a company director in India, DIR-3 KYC filing is the most important compliance process. The Ministry of Corporate Affairs (MCA) has now decided to extend the due date of filing DIR-3 KYC upto 15th October, 2025.Accordingly, relevant rule change is being notified here through.# MCApendiApplicable to Only Those Who Missed Earlier Deadline# ModiReformspic.twitter.com/cOf2HdoJgl— LocalCircles (@LocalCircles) September 23, 2019This extension will help directors who had missed earlier deadline of 30th September cover maximum number of people without penalty.

For hassle-free compliance, You can always take the assistance of a reliable CA in Delhi who can manage all your MCA filing, DIN activation and company compliances error- free.

👉 Last Date of DIR-3 KYC: 15th October 2025

👉 Previous Deadline: September 30,2025; Former deadline (which is now replaced): September 30th of every year

🔎 What is DIR-3 KYC and Why It’s Important?

DIR-3 KYC It is a mandatory filing for every director possessing the DIN. This form is a way to keep your DIN Alive and also that MCA have the latest records on who are the directors of this company.

Types of filings:

- DIR-3 KYC Form – At the time of first filing and also when there are changes (mail id, mobile number address etc.)

- DIR-3 KYC-WEB – In case the director filed in previous year and there are no changes in PAN number or Passport details

When you file on time, via a CA firm in Delhi for Company Registration, then you keep penalties at bay and maintain your company’s corporate compliance.

✅ Why to File DIR-3 KYC with CA in Delhi?

- Preserves Active DIN – Must for compliance of MCA and filings

- No Penalty – After Due Date you can pay with ₹5,000 penalty

- Professional Accuracy – Verified by the Practicing CA/CS/CMA

- Perfect Compliance – No mistakes, no rejections, no last minute panicking

When you hire a CA Delhi professional, it means that your filings will be correct for the appropriate DSC and before MCA deadline.

📌 MCA Extension – Key Points.

- Extended Due Date for DIR-3 KYC: 15th October, 2025

- Grace period: Additional 15days without any late fee

- Post Deadline: MCA will flag DINs as “De-activated due to non-filing of DIR-3 KYC”

📝 How to File DIR-3 KYC

(A) Filing for the first time – DIR-3 KYC Form

- Download form MCA portal has The Directorate of Legal Metrology, Karnataka is the Department charged with implementation of the Act.

- Enter personal details (Name, PAN, Aadhaar, Email, Phone and Address)

- Obtain Certification from Practicing CA/CS/CMA (As a Practicing professional How do you get this done?)

- Filing with Digital Signature Certificate (DSC)

(B) Same Filing – DIR-3 KYC-WEB

- Login to MCA portal

- OTP based Authentication: Verify DIN, Email & Mobile

- Submit and download acknowledgment

⚠️ Common Mistakes Directors Make

- ❌ Not changing addresses/emails/phones prior to filing

- ❌ Using an expired DSC

- ❌ Failure to have professionally certified, for people filing for the first time

- ❌Doing on last day when MCA Portal get struck to due overloaded

You can seek the assistance of a leading CA firm in Delhi to circumvent these mistakes and keep your DIN alive.

💼 Sunil K Khanna & Co. – CA Firm in Delhi You Can TrustIf you are looking for a trusted CA in Delhi, then Sunil K Bhanna & Co. is one of the most established CA firms in the capital city delivering all-inclusive business compliance and advisory facilities:

- ✔️ DIR-3 KYC & MCA Compliance

- ✔️ DIN Activation & Corporate Filings

- ✔️ Income Tax & GST Advisory

- ✔️ Audit & Assurance Services

- ✔️ Business Advisory & Financial Planning

Let us be your experts so that you can avoid wasting time, incurring penalties and ensure that maintaining corporate compliance is not a burden.

📅 Final Reminder

What is the Last to Date Filing of DIR-3 KYC 2025: October 15, 2025

Penalty Late Fee: ₹5,000 per DIN (from the due date)

Risk: DIN will be deactivated

👉 Do not procrastinate — Immediately approach a CA in Delhi for error-free DIR-3 KYC filing.

📞 Talk to Sunil K Khanna & Co., your trusted CA Delhi partner for a full MCA compliance and corporate advisory solution.

❓ FAQ on DIR-3 KYC Filing

Q1. What is the due date of DIR-3 KYC 2025?

➡️ 15th October 2025

Q2. What happens if I don’t file?

➡️ Your DIN will be ceased and a cost of ₹5,000 shall be imposed on you.

Q3. What is the Difference between DIR-3 KYC and DIR-3 KYC-WEB?

➡️ DIR-3 KYC Form (when filing for first time or after changes)

➡️ DIR-3 KYC-WEB – For filing of repeat entries and there are no changes

Q4. Who can certify DIR-3 KYC?

➡️ CA / CS / CMA (Practicing) ✅ Emolument: Not mentioned.